How Much Money Do You Really Need to Start the Wheel Strategy?

Some investors want to use the wheel to generate a few extra bucks.

Others want it to become a serious monthly income stream.

Both are possible — but they require different amounts of capital.

This article walks through what’s realistically possible at different account sizes.

You’ll see what the wheel can and can’t do at the $2k level, the $10k level, and beyond — so you can set the right expectations and build from there.

Why Capital Matters

The wheel strategy isn’t complicated.

You sell a put. If you get assigned, you own the stock. Then you sell a call. If that gets assigned, the stock is sold — and you start over.

It’s methodical. It works best when done consistently.

But to do that, you need the capital to back it.

Not because the strategy is risky — but because it’s cash-secured.

Every put you sell has to be covered by enough cash to actually buy the stock if you’re assigned. Every covered call requires you to already own 100 shares.

That’s why account size matters.

Not to impress anyone — just to operate the system.

And that’s where a lot of people get stuck.

They hear the wheel can generate income, but then realize that one contract of a $50 stock means $5,000 tied up. That’s a full trade. No leverage, no funny math.

So the natural question is:

How much do I really need to make this work?

The answer depends on what you’re trying to get out of it — income, learning, or both.

We’ll walk through the realistic levels next.

Not the theory — just what you can actually do with different account sizes, and where the strategy starts to make sense.

Minimum Capital Tiers

Let’s keep this practical.

Here’s what the wheel strategy looks like at different account sizes — no theory, just real numbers and what’s actually possible.

🪙 Under $2,000

It works in name only.

You’re limited to stocks under $20 just to sell one put. That usually means thin premiums, questionable companies, and almost zero room for adjustment if things go sideways.

You’ll see people try to “wheel” penny stocks or meme names in small accounts. It’s not a strategy — it’s a gamble with an income label slapped on top.

If you’re here, use the time to learn.

Track trades on paper. Study charts. Understand position sizing.

But don’t expect meaningful results with $2,000 or less.

💵 $5,000–$10,000

This is where things start, but just barely.

You can trade one or two symbols — usually something in the $15–$40 range — and cycle through the wheel one at a time.

Returns might be decent in percentage terms, but the actual dollars are small. A 20% year on a $7,500 account is $1,500 — or about $125/month before taxes or fees.

It’s a good level to test your process.

You’ll learn discipline, execution, and how premiums move.

But you won’t generate real income yet.

💰 $10,000–$25,000

Now the wheel actually functions.

You have the capital to:

Trade 2–3 tickers at once

Choose better quality stocks (not just cheap ones)

Use weekly options for faster income rotation

Handle an assignment without locking up the whole account

At this level, you’re still not printing cash — but you’re building a system.

If you use margin responsibly, your buying power doubles. That gives you more flexibility, not more risk — as long as your sizing is still based on real cash.

This is the sweet spot for beginners who want results without stretching.

🏦 $25,000 and Up

At this size, you can start thinking in terms of income.

A 2% monthly return means:

$500/month on $25k

$1,000/month on $50k

$2,000/month on $100k

Not guaranteed. Not passive.

But repeatable — if you stay disciplined.

With more capital, you can:

Spread across sectors

Take only high-quality trades

Keep some cash aside for rescue plays

Walk away from bad setups without fear of missing out

This is where the wheel shifts from a learning tool to a monthly income stream.

Should You Use Margin?

Most traders running the wheel eventually use margin.

Not to chase more trades — but to unlock flexibility.

Here’s why it matters:

If you have $10,000 in cash, a margin account gives you $20,000 of buying power.

That means you can sell puts on a $20 stock (1 contract = $2,000) and still have room to manage other positions.

It doesn’t double your returns. It doubles your breathing room.

But only if you treat that borrowed buying power like real cash.

That means:

Sizing trades as if you only had the original $10k

Keeping cash available for assignment

Avoiding the temptation to fill every dollar of margin just because it’s there

Used correctly, margin reduces friction.

Used poorly, it just magnifies mistakes.

If you’re disciplined with position sizing, margin is a useful tool — not a risk.

Just don’t confuse available buying power with money you actually have. That’s where people get hurt.

What Kind of Income Can You Expect?

There’s no fixed number. The wheel doesn’t guarantee results.

But most disciplined traders aim for 1% to 3% per month on their deployed capital — depending on market conditions, trade quality, and risk tolerance.

That doesn’t mean you hit 3% every month, or that you should try.

It means the range is possible when you’re patient and selective.

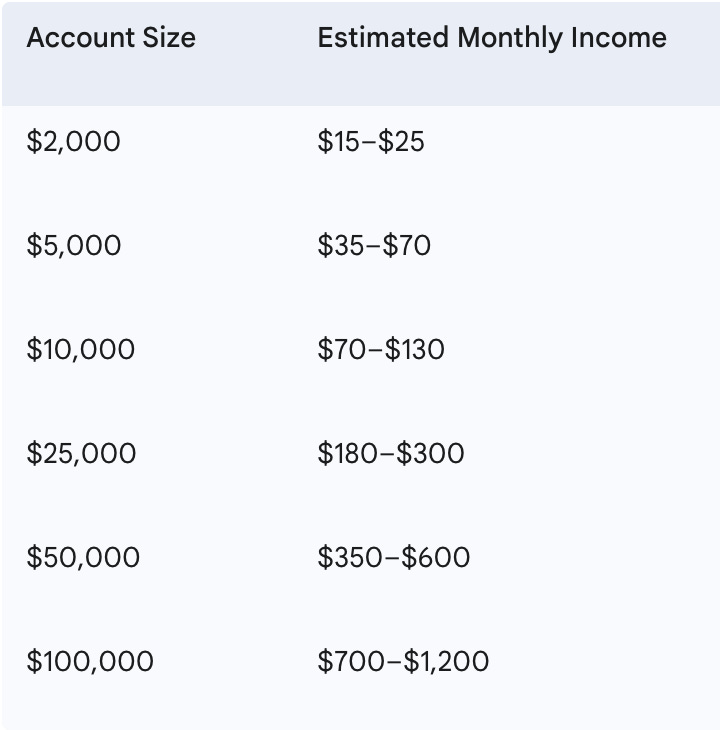

Let’s put that into simple numbers:

This is gross income from option premiums — before taxes, fees, or losses.

It assumes you’re putting capital to work with consistency and not taking oversized risks.

Some months will come in lower. Some higher.

What matters is that the system works over time.

And for that to happen, you need two things:

Enough capital to take proper trades

The discipline to stay within your rules

That’s the whole point of this article — helping you understand whether you’re in a position to run the strategy the way it’s meant to be run.

Final Thoughts

The wheel strategy isn’t a magic trick.

It’s a repeatable system that works — if you give it the room it needs to breathe.

That means having enough capital to:

Sell options on quality names

Stay patient when trades take time

Keep cash available for adjustments

Avoid squeezing into junk setups just to stay active

If you’re starting with a small account, that’s fine. Just adjust your expectations. Use the early stages to build the habit — not the income.

If you’re above the $10k–$25k range, you can run a full version of the strategy and start seeing consistent results. Not every month will be perfect, but the process will start to work the way it’s designed.

This isn’t about hitting home runs. It’s about building a clean, low-drama income system.

And that starts by knowing the simple answer to the first question every trader asks:

Do I actually have enough capital to do this right?

Now you do.

Thank you for reading!

Disclaimer

This content is for educational purposes only. It is not financial advice, and nothing here should be interpreted as a recommendation to buy, sell, or hold any investment. You are responsible for your own financial decisions. Always do your own research or consult a qualified advisor before taking action.